Probate in Arizona is much simpler and more economical than in many various other states. While many states have taken on the Attire Inheritance Code and eliminated inheritance and estate taxes, regarding 20 states still charge beneficiaries a fee for the privilege of inheriting even small amounts of property. Arizona has no inheritance or estate tax.

Identifying whether an inheritance is transferable utilizing a sworn statement

What is ‘estate residential or commercial property’? Estate property is personal effects that the deceased owned exclusively in his/her name. A stock, vehicle, or interest-bearing account that just bears the deceased’s name on the deed is estate residential or commercial property. Checking account that are vessel (pay after fatality) accounts; joint savings, checking, or financial investment accounts are exempt to probate. Autos with a second person on the title action or a recipient classification; and life insurance policy policies with a named beneficiary are also exempt to probate.Для получения дополнительной информации, пожалуйста, нажмите здесь district of columbia affidavit of small estate На нашем веб-сайте None of these joint or probate properties are included in the estimation of the estate’s dimension. If you add up all probate assets and the overall is $75,000 or much less, Arizona law permits successors to utilize a straightforward and low-cost procedure to provide the estate. It is called ‘Affidavit of Repossession of All Personal Property.’

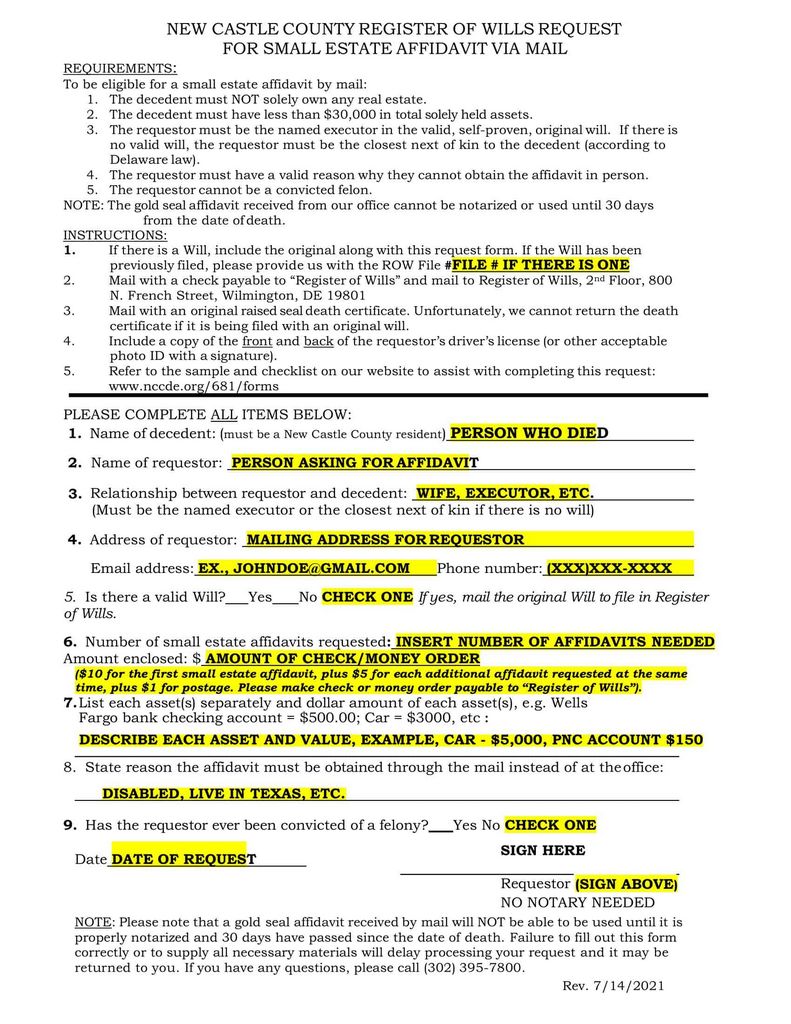

Procedure for accrediting inheritance for Small property utilizing a testimony

The process for submitting an affidavit is clearly laid out in the statutes. ARS §& sect; 14-3971 states that a testimony can not be made use of up until a minimum of 30 days have actually passed given that the death. Additional requirements for making use of the affidavit procedure are that no personal representative (executor) has actually been assigned by the court and the value of the personal effects does not go beyond $75,000. Personal effects is basically anything that is unreal estate. This treatment can additionally be made use of if additional personal effects of up to $75,000 is uncovered after the closure of conventional probate proceedings. In this last situation, the law requires that the individual rep be dismissed and the probate process have actually been closed for greater than a year.

Claimants to the estate finish a type called an ‘Testimony of Collection of All Personal Property.’ You can find this type in the self-help area of the Superior Court website. You look for www.azcourts.gov, click Superior Court, after that click the region where you live. Go to the self-help section of the Superior Court site for the region and find the probate types and directions. Complete the Affidavit and sign it prior to a notary or the region clerk. After that take the authorized and notarized Sworn statement to a financial institution, the deceased company (if there is a wage debts), or an additional institution that holds the deceased’s personal property. Some banks might require that the Testimony be licensed by the court. In this situation, you will certainly require to go to the staff of court, pay a charge, currently $27.00, and have your affidavit licensed. You might additionally require a duplicate of the death certificate when you submit your sworn statement. You may send out duplicates of the affidavit and death certification to non-local firms. The testimony will additionally permit the DMV to alter the title of any kind of car had by the deceased to mirror the modification in possession.

The testimony should explain your connection to the dead and why you are entitled to the personal effects. It asks whether the deceased had a will and whether you are named in it.

As we age, we require to meticulously think about just how we desire our accounts to be treated after we die. Adding member of the family to the ownership of your lorry or your bank accounts is a big danger. When you possess these accounts collectively with an additional individual, the co-owner has equal rights to the car or cash in the account. Think about joint accounts only if you are absolutely particular that you can trust the various other individual to watch out for your benefits. There have actually been a lot of cases where a child or brother or sister has taken all the cash, leaving the initial account owner with absolutely no balance. That’s not a danger you intend to take. A safer alternative is to make your checking account covering accounts. SHEATHING (payable on fatality) accounts cost nothing to set up; there are no restrictions on the quantity the account can hold; and the recipient has no right to the cash while you live. The only downside is that you can not mark an alternative recipient.

Vehicles can be managed in similar way, using a recipient classification to move the vehicle after death. You can download and install an easy form from the Arizona Department of Motor Autos website. You just fill out the type, have your trademark notarized, and offer the form to the MVD, connected to the car’s present certificate of title. The MVD will after that issue a brand-new certificate of title with the recipient classification. A recipient classification is a lot more safe means to transfer ownership after your fatality than joint possession.

Testimony of transfer of possession of real estate

There is likewise a kind for the Affidavit of Transfer of Title to Real Estate, however this is somewhat extra complicated. It can be filed by a spouse, small youngster, or adult beneficiary. The Testimony of Transfer of Title can not be submitted with the court until at least 6 months after the fatality. The person or persons signing the Testimony has to certify that the court has actually not designated a personal representative or that the probate procedures were closed more than a year ago and the individual representative has been released. The notaries have to certify that the worth of the property is $100,000 or much less nevertheless liens and encumbrances are released. They should certify that nobody apart from the signatures has any kind of legal rights to the property and that no tax obligations schedule. The Sworn statement allows the signatories to declare assistance in lieu of propertystead ($18,000), inheritance tax exemption ($7,000), and household help. As soon as finished, the Affidavit needs to be filed with the court, together with the initial title web page of the Probate Application and the original will (if any kind of). Much more thorough details on this procedure can be discovered in the guidelines posted on the High Court Self-Help Centre.